Emission control limits the release of harmful gases from cars into the atmosphere. This includes hydrocarbons, carbon monoxide and oxides of nitrogen from engines, crankcases, fuel tanks and carburettors.

Emission control systems are developed to prevent or reduce pollution from these sources and keep the atmosphere cleaner for everyone. Many advanced countries have introduced Low Emission Zones to combat the pollution from cars to minimize the greater threat to human and environmental health.

But the proposed emission tax does not seek to reduce or prevent the pollution, since the government has no policy to replace the existing behaviour or provide the infrastructure.

As air quality becomes an increasingly political issue globally, measures are being put in place to discourage more polluting vehicles from entering areas where air quality is poor.

In Ghana’s case, the proposed charges are credulous. This means that someone living in a less polluted area, for example, in the rural areas is going to be affected.

Emission taxes have many important advantages, such as environmental effectiveness,

Economic efficiency, the ability to raise public revenue and transparency. Also,

Environmental taxes have been successfully used to address a wide range of issues including waste disposal, water pollution and air emissions. Regardless of the policy area, the design of environmental taxes and political economy considerations in their implementation are crucial determinants of their overall success.

Environmental tax can directly address the failure of markets to take environmental impacts into account by incorporating these impacts into prices, environmental pricing through taxation leaves consumers and businesses the flexibility to determine how best to reduce their environmental “footprint”, and it enables lowest-cost solutions, provides an incentive for innovation and minimizes the need for government to attempt to “pick winners”.

The environmental tax bases should be targeted to the pollutant or polluting behaviour, with few (if any) exceptions. The scope of such environmental tax should ideally be as broad as the scope of the environmental damage; the tax rate should be proportionate with the environmental damage and the tax must be credible and its rate predictable in order to motivate environmental improvements, the tax revenues from environmental tax can assist fiscal consolidation or help to reduce other taxes.

In view of this distributional impact, environmental tax can, and generally should, be addressed through other policy instruments.

To implement this, a clear communication is critical to public acceptance of environmental taxation and it may need to be combined with other policy instruments to address the issues.

A poorly designed environmental tax that does not bear directly on the source of Environmental damage can impose additional economic costs. A general principle of taxation is that taxes should, as far as possible, be levied on final production, consumption and incomes.

Taxes levied on intermediate products impose additional economic costs by distorting methods of production. Of course, the aim of environmental taxes is precisely to provide incentives to change production techniques to make them less polluting.

Hence the importance of good environmental tax designs is to ensure that they do just that; and do not introduce other distortions to production technologies.

However, this is a situation where the government has not provided any alternative, the infrastructure must be available, efficient railway or tram systems, efficient bus or coach systems, electric car charging points etc. so without these infrastructures what does the government want to achieve.

The polluters will continue polluting and it is worth saying that the government should rather increase the roadworthy certificate that will have a significant meaning than calling it emission charges because it will fail to address the environmental issue. Or maybe the government has no intent to address any environmental issues.

The impact on this particular proposed emission is going to be huge, it will be added to production cost, because it will increase transport and distribution cost which will directly affect food and its related goods and service.

As soon as transport goes up distribution cost also goes up that increases food cost as soon as food prices goes up, everything goes up with it including inflation. It can deeply impact our economy and welfare, influencing numerous macroeconomic factors such as inflation, Gross Domestic Product, employment levels, since it will not stimulate business growth and even the balance of payments, because the increase will not make our goods and services competitive.

Transportation cost plays an essential role in macroeconomics, affecting several variables and factors in a national economy. A good example of this is its effect on inflation and the overall pricing of goods and services.

An increase in transportation costs can lead to increase in product prices, contributing to inflation. It is because these costs form part of the final price of goods and services. In these circumstances, people and businesses will not be able to build capital.

I suggest that the proposed emission tax must be targeted to solve an environmental issue, by selecting areas where it is highly polluted to deter pollutants, even if the government must provide alternatives, for the government to look for revenue generation aspect only without a purpose will do serious harm to the economy.

It is pivotal for the government to focus on non-filers and uncover black money in the economy and untapped areas. The Income-Tax department should implement stronger mechanisms to identify persons who resorted to tax evasion and bring them under the tax net.

The government must focus on unearthing black money within the country and that parked abroad and fine measures or form a Special Investigation Team for this.

Any plans to widen the tax base must be identifying non-filers, using annual information returns, capturing new information sources such as under-reporting of immovable property, furthermore, widened the tax base to include environment, advertising, even DVLA and the police have a lot to do on defective cars, cars without lights or dangerous tyres etc.

The problem we have in our continent is not about taxation but is about corruption and we should be honest to ourselves as peoples’ worth does not correspond to the amount of taxes they pay.

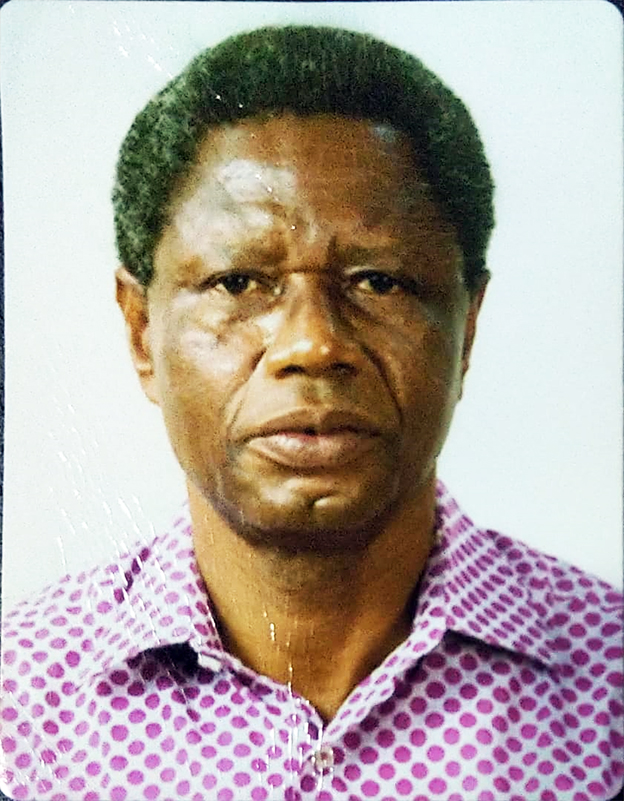

By Dr Edward Kwadwo Yeboah, Kumasi

The Writer is an Economic Development Consultant