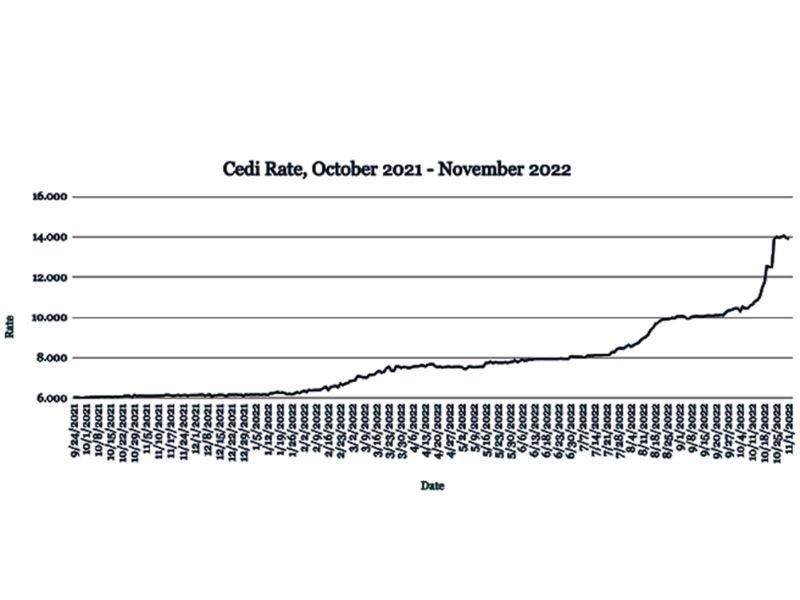

The Cedi recovered strongly against the dollar, appreciating to 13 from 14.05 at last week’s close after President Nana Akufo-Addo said bondholders won’t suffer losses as part of any IMF bailout.

The recovery was aided by a Bank of Ghana clampdown on illegal FX traders. Dollar demand remains heavy ahead of the Christmas period as importers seek to pay for goods in time for the festive shopping season.

We expect the currency’s recovery to be short lived, with rising inflation and high debt levels driving the Cedi back to the 14 levels in the near term.

Twin priorities for Africa leaders at COP27

With Africa contributing only around 3% of global emissions but devastated by extreme weather, such as recent floods displacing millions and destroying farmland across west Africa, the continent’s leaders have two core objectives at the UN’s COP27 climate conference next week.

The first is that developed nations should pay reparations for the impact that climate change is having on Africa, with the funds used to build infrastructure that will be more resilient against extreme weather and support transition to renewable energy.

The second objective is to strike a balance between calls for a global halt to new fossil fuel projects and the priorities of economic development in Africa and the need for new sources of oil and gas to address energy shortages in Europe.

Progress on either of these broad objectives could provide relief for Africa’s economies and currencies.

Naira tumbles to new low as CBN to void high value notes

The Naira plunged to a new low against the dollar on the unofficial market, trading at 850 from 772 at last week’s close.

Nigerians rushed to buy dollars after the central bank said it plans to redesign high value Naira notes by mid-December and void any old notes still in circulation by the end of January next year.

The spread between the official and unofficial rates is now more than 88%, the largest ever gap, according to Bloomberg.

The note redesign is intended to mop up excess funds, reduce counterfeit notes and hamper ransom payments from terrorists and kidnappers.

The central bank has expressed concern about the amount of currency in circulation outside of the banking system, reducing the efficacy of its policy levers.

With dollar demand continuing to outpace supply, and with no more central bank support in the parallel market, we expect the Naira to lose further ground in the near term.

Rand loses ground on Fed hike

The Rand weakened against the dollar, trading at 18.27 from 18.12 at last week’s close after the US Federal Reserve raised interest rates by another 75 basis points to its highest level in 14 years.

The Rand had been trading even lower at the start of the week, briefly touching 18.40, before recovering slightly amid renewed optimism about China’s economic outlook.

Domestic concerns also continue to pile pressure on the local unit, such as ongoing power cuts and uneven taxation (with about 4% of the population being responsible for 84% of the country’s tax receipts).

We expect the Rand to continue trading in the 18s in the week ahead, though it is unlikely to weaken beyond 18.50.

Egypt Pounds plunges to record on flexible FX move

The Pound depreciated sharply against the dollar, hitting a fresh record low of 24.15 from 19.67 at last week’s close after the country signalled it was moving to a flexible exchange rate as part of the $3bn IMF loan deal agreed last Thursday.

The Pound’s weakening is likely to fuel inflation, which hit a four-year high of 15% in September. Egypt’s economy has been struggling from the twin effects of the Covid-19 pandemic and commodity price shocks caused by Russia’s war in Ukraine.

That has sparked a foreign investor exodus that is putting more pressure on the Pound, which we expect to sink further in the weeks ahead as the currency floats more freely and adjusts to market based levels.

Kenyan Shilling at new low set for further losses

The Shilling declined to a fresh record low, trading at 121.35/121.55 from 121.15/121.35 at last week’s close amid the familiar trend of elevated dollar demand from energy and manufacturing businesses that is outpacing supply.

The central bank continued to support the currency using its dollar reserves, preventing a larger slide. FX reserves fell to just under $7.3bn from slightly above a week earlier.

We expect the Shilling to weaken further in the week ahead as the US Federal Reserve’s 75 basis point hike this week strengthens the dollar.

Ugandan Shilling to weaken on debt concerns

The Shilling strengthened against the dollar, trading at 3770 from 3808 at last week’s close.

Energy Minister Ruth Nankabirwa Ssentamu said Uganda plans to start pumping its oil reserves in 2025, with the country likely to court Chinese investment to finance the East African pipeline project. Meanwhile, African health officials said the Ebola outbreak is under control due to successful contact-tracing efforts.

The World Health Organization upped its Ebola risk assessment for the country and the wider region as infections reached the capital Kampala.

The currency’s stronger showing may be short lived. We expect concerns about Ugandan debt levels will cause the Shilling to depreciate in the coming days.

Shilling stable as Tanzania President visits China

The Shilling was broadly unchanged against the dollar, trading at 2332 from 2331 at last week’s close. Petrol prices dropped for a third month in a row at the start of November, supported by the government’s TZS200bn fuel subsidy.

While that handout is protecting Tanzanians from inflationary strains, there are concerns about the sustainability of the subsidy and the potential long-term effects it could have on the economy.

President Samia Suluhu Hassan is visiting China this week as Tanzania seeks to drum up investment for the East African oil pipeline that will pump crude from Uganda through to Tanzania’s Tanga port.

We expect the Shilling to be more volatile against the dollar in the days ahead following the US Federal Reserve’s latest rate hike.

Credit: www.azafinance.com