The Bank of Ghana Monetary Policy Committee (MPC) on Monday, January 29, 2024 announced a cut in the key policy rate of 100 basis points, from 30% to 29%. This sounds like a big joke. It is hard to imagine what impact our BOG officials expect a 1% reduction from 30% to make on lending rates, inflation rate, exchange rate or economic growth, let alone what they expect to learn or observe from it. I wonder whether they have determined the correlation between interest rates, inflation and exchange rates in our country.

The hesitant 1% rate cut to 29% is particularly surprising given their expectation that headline inflation would “ease to 15%±2% by the end of 2024 and gradually trend back to within the medium-term target range of 8%±2% by 2025”. I do not see the relationship between the expected or target 15%±2% inflation and the high 29% monetary policy rate.

It gives the impression that our top economists do not believe in themselves or their own forecasts. More worrying is the possibility that they do not believe in their own numbers, given their new claim of signs of “emerging recovery”, having previously told us that the economy had “turned the corner”.

Policy rate and open market operations

A central bank’s policy rate and open market operations are supposed to influence the rate of inflation. But BOG officials still have a fixation on headline or year-on-year inflation, and so cannot depart from their reactionary monetary policy approach, which responds to what had transpired, that is, past one-year price changes, instead of their expectation of inflation (15%±2% this year). So, the 1% reduction in the policy rate appears to be a reaction to the 3.2% fall in headline inflation in December to 23.2%%, from 26.4% % in November.

Thus, the key rate that commercial banks use as reference for lending has been reduced to 29% after being pegged at 30% for six months. It is also invariably the reference rate for the Government’s domestic borrowing, setting a limit to the Government’s ability to exploit its power as the largest borrower.

BOG often talked about “mopping up excess liquidity” without defining what was optimal. But an interest rate policy that results in 30% plus return to money market investors is itself responsible for the delivery of “excess liquidity”.

Victims of a myopic approach

I acknowledge the complexity of the interplay of the various macroeconomic variables. But as I wrote in my previous article, “BOG has failed us”, our ridiculously high interest rates have been partly responsible for our high inflation rates, constantly weakening cedi, business failures, joblessness, and worsening poverty levels, pushing many of our younger compatriots into a desperate search for greener pastures abroad. I am surprised that the IMF not only backed but has insisted on this approach over the years.

It is the reason why businesses have to borrow at 36%, at which rate the amount of indebtedness almost doubles every two years (The Rule of 72). It has made it impossible to achieve the much-needed diversification and restructuring of our economy. So our foreign-dominated economy has remained dependent on the export of raw materials and the importation of finished products.

We have been victims of this myopic approach to monetary policy, that has imposed structural bottlenecks on our economy, for over 20 years. This has made it impossible for Ghana to meet the convergence criteria for the Ecowas single currency, the Eco. Our economy needs urgent stimulation, and a timid 1% rate cut from 30% to 29% will not help.

The cedi has suffered over the years, the dollar having been on the loose, gaining almost 200% over the cedi since 2017. But for the currency redenomination of 2007, US$1 would have been selling at a bagful of cedis, GH₵120,000, today. We cannot stabilise the exchange markets while treasury bill investors are making 30% nominal return on their cedis. Parity laws tell us that will not happen.

Global shocks or self-inflicted tragedy?

BOG will blame global shocks for our woes. But as I pointed out previously, Zambia and Kenya, for example, exposed to the same global shocks, have done remarkably better.

Zambia recorded 12.9% and 13.1 inflation rates in November 2023 and December 2023,respectively. Kenya recorded 6.8% and 6.6%, respectively. Today, the Bank of Zambia’s prime rate is 11% and that of the Central Bank of Kenya 13%.

Reckless borrowing and corruption have combined with high cost of borrowing to make Ghana Africa’s most indebted country. Sadly, after taking the difficult step to reduce domestic debt through the draconian DDEP, we are still piling up short term debt – 91 Day Bill at 29.35%, 182 Day Bill at 31.95% and 364 at 32.49% – even when demand is very high.

High interest rates evidence instability. Thus, the unnecessarily high domestic interest rates have fed into external market perception of our outlook, giving international capital market predators a field day. We cannot through our policy rate give an impression of high inflation or high credit risk outlook and expect the external financial markets to think differently.

BOG’s approach has been costly for us in the international financial markets,where it has created an exaggerated risk perception, with adverse implications for our credit rating. COCOBOD is currently suffering the consequence, having to borrow at an unprecedented 8%.

Who is benefiting?

In the business sector, banking has been and will be the only beneficiaries, baring any future haircuts. And soon, we will be hearing the usual BOG’s self-serving statement that,“The banking industry’s performance has defied the general economic downturn with strong growth across key metrics including total assets and deposits, as well as sustained improvement in profitability…”. But it does not require any banking ingenuity to make money in a 30% plus interest rate environment, even after providing for high levels of non-performing loans.

British financial economist and lecturer at Aston University in Birmingham, Dr. SajidMukhtar Chaudhry, was right when he said that banks in Ghana are too profitable. Hesuggested the imposition of a ‘Bank Tax’, as done by the likes of Australia, to generatemore revenue for the Government. He thinks “it is not normal for banks to be thatprofitable”, and he expressed surprise that banks “earn much more than other industries”in Ghana.

Ultimately though, BOG were themselves victims of their bad monetary policy,announcing massive losses in 2022, totaling GH₵60 billion, and year-end negative networth of GH₵55 billion, making it technically bankrupt. This is unprecedented in ourhistory. The loss, equal to about 10% of our 2022 GDP, is one of the largest one-yearlosses ever recorded by a central bank.

Why the reluctance to cut rates?

But why is BOG clinging to a policy and an approach that has not only failed to keepinflation in check, but also made it difficult to effect the needed structural changes in theeconomy? The Bank’s virtual monopoly over government business and their ability toprint money, no doubt, makes it a survivor.

One thing is clear however: BOG, given its extravagant spending, cannot hold itsown in a low interest rate environment. This probably explains the need for the Bankto keep its policy rate high to protect its main revenue source – interest income. Its“interest and similar income” amounted to GH₵5.09 billion in the difficult post-COVID2022, up 47% from GH₵3,46 billion in 2021, and represents 92.7% of its total operatingincome of GH₵5.49 billion.

It may also be the case that BOG is reluctant to see interest rates fall quickly at this criticaltime when it needs to make more money to survive bankruptcy. A GH₵55 billion negativenet worth is a huge burden.

Living in a different world

Details of BOG’s 2022 annual report says a lot. As I pointed out previously, budgeted andactual expenditures do not look like those of a struggling country’s central bank: US$ 250million for a new head office, equivalent to 0.35% of our GDP; GH₵97.4 million for travel;GH₵131 million for motor vehicle maintenance/running; GH₵32 million forcommunication; GH₵67 million for computers; GH₵207,7 million for premises andequipment; GH₵336.9 million for currency issue (currency in circulation amounted toGH₵40.73 billion); GH₵287.83 million for other administrative expenses, etc.

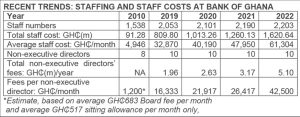

Personnel costs amounted to GH₵1.62 billion. With a total of 2,203 employees, thismeant an average remuneration of a colossal GH₵735,361 per employee in 2022 orGH₵61,280 monthly per employee, including several allowances. These employees alsohad staff loans amounting to GH₵1.247 billion, an average of GH₵566,046 per head.

BOG is also reported to be remodeling its regional offices, while investing GH₵142 millionin a 50-bed guest house in Tamale.I still cannot believe BOG and its staff are living in a completely different reality. Apartfrom its excessive operating expenses, proper cost-benefit analysis would not justify itsinvestment in a new head office building and non-core activities like a hospital and guesthouses.

BOG vs Bank of England (BOE)

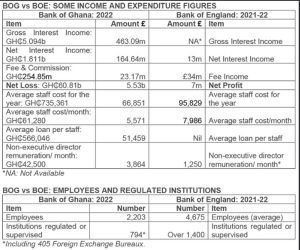

It is hard to believe how some BOG’s operating income and expenses compare with those of Bank of England (BOE). For example, BOG spent GH₵1.62 billion (£147.27 million at 2022 average cedi-pound exchange rate) on its 2,203 employees, translating to £66,851 per staff. BOE on the other hand, with an average labour force of 4,675 per their 2021-22 financial report, spent £448 million, an average of £95,829 per staff. Unlike BOE staff, BOG staff also enjoyed staff loans, with an average of GH₵566,046 (£51,459) outstanding per employee.

BOE’s reports disclose the remuneration of individual executives. But BOG’s financial statements do not. So, a comparison is not possible. But BOG’s ten (10) non-executive directors earned GH₵5.1 million in 2022, averaging GH₵510,000 (£46,364) per director for the year, or GH₵42,500 (£3,864) per month.

BOE’s statement on the remuneration of non-executive directors shows that BOG’s non-executive directors are much better remunerated than their BOE counterparts. BOE’s rates, which were effective from 1 June 2009, were set at £15,000 per annum (£1,250 per month) for non-executive directors. Committee Chairs receive a little more.

Non- executive directors do not receive any additional fees for serving on Committees. I wonder whether BOG directors’ allowances were determined “in consultation with the Minister of Finance” as required under the Bank of Ghana Act.

One wonders also how the technically bankrupt institution is funding its exorbitant expenditures. BOG’s extravagance is typical of poorly supervised cash-rich state-owned enterprises, many of which increase remuneration and expenditures at will, as shown by the trend in staff numbers and costs at BOG captured below:

*Estimate, based on average GH₵683 Board fee per month and average GH₵517 sitting allowance per month only, So, can budget considerations be an important reason for BOG continuously keeping interest rates high, by linking it to year-on-year inflation instead of expected inflation?

Effectiveness of BOG’s inflation targeting

I want to emphasise that BOG’s approach to inflation targeting:

- has not worked and is unlikely to work because its policy rates (currently 29%) do not appear to have any relationship with its target or expected inflation rates (currently 15% by year-end), and

- has only succeeded in importing past inflation into the future, trapping us in a vicious circle of high inflation→ high interest rate→ high cedi depreciation→ high inflation,making Ghana’s inflation and currency depreciation rates some of the worst on the continent.

By virtually indexing its policy rate to year-on-year inflation, BOG has indexed our economy to past inflation. This kind of indexation produced the self-fulfilling prophesy that led to the real crisis in Brazil in 1999, when the value of the Brazilian real dropped 35%.

As I pointed out previously, the reduction that we saw in the headline inflation rate recently was largely the result of what happened to prices one year earlier, the effect of which should die out. It should also be noted that, even though maintaining the current high policy rate will not help the fight against inflation, a reduction in BOG’s policy rate from 30% to 20%, for example, should not necessarily produce inflationary consequences. Thus, the timid 1% reduction may have been influenced by the survival issues surrounding BOG itself.

Urgent need for change

In its Annual Report and Accounts 1 March 2021 – 28 February 2022, BOE described itself as “a human and humble Bank, in step with the changing world”. Their definition of a human Bank “is one where colleagues feel able to be themselves and speak openly and honestly about their views.

A humble Bank is one where we listen as much as we speak, and recognise that we are made stronger by learning from others. And a Bank in step with the changing world is one that looks outwards and forwards and applies those insights to our enduring mission”.

Having failed over the years to keep inflation in check, it is sad to see BOG pursue the same approach that has failed to deliver the desired outcomes. It is about time BOG listens and applies more forward-looking principles in pursuing its mission. Success in policy formulation requires open-mindedness, outstanding imagination, and sound judgement.

BOG’s objectives and autonomy

I want to emphasise that price stability is not an end in itself. Probably more important are growth and employment generation, in which the BOG must show interest. We need to clarify BOG’s mandate and improve its governance to mitigate the profit motive.

As I pointed out previously, no institution of state can claim absolute autonomy, and neither does the independence of the BOG require that the Governor should be Chairman as well. It will, at the very least, enhance internal check if the two roles are separated.

At BOE, the effectiveness and authority of its Court (Board) of Directors provides the

necessary balance. The Court:

- has an independent non-executive chairman

- has an Independent Evaluation Office that supports its work, and

- may commission external performance reviews (including, retrospectively, into

policy decisions).All said, if BOG does not change its predatory lending practices, it will continue toundermine the real sectors of our economy and frustrate efforts to develop the bond and mortgage markets. Worst still, we will, sooner than later, be back to the IMF for the 18th time.

Disclosure and for the records

It is almost twenty-one years, May 2003, since I first complained about BOG’’s reactionary self-fulfilling monetary policy approach putting us in a vicious circle of high inflation→ high interest rate→ high cedi depreciation→ high inflation. I received support from the distinguished economist, the late Hon. JH Mensah. I was subsequently appointed to the Board of BOG by HE President JA Kufuor, 2003-2008, and later by HE President Prof. JEA Mills, 2009-13. But I could not persuade the Bank to change its approach.

By TogbeAfede XIV