Newmont fulfilled its key fiscal obligations with the Government of Ghana (GoG) with the payment of US$220 million related to its local mining operations. These contributions were made in compliance with the mining laws of Ghana, as well as Newmont’s Revised Investment Agreement with the government.

The payments were made in two amounts:

- US$50 million for Newmont’s 2025 interim carried interest payment, bringing the company’s 2025 year-to-date carried interest payments to the GoG to US$80 million.

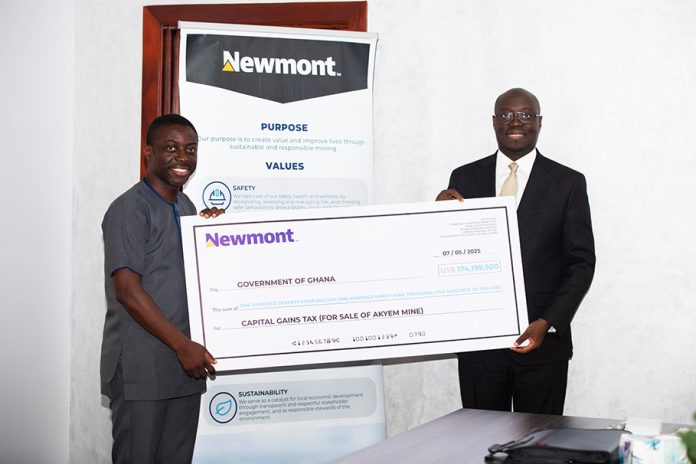

- US$174 million of capital gains tax, occasioned by the sale of the company’s Akyem mine.

“We take these statutory payments seriously, guided by our overall commitment to value sharing in jurisdictions where we operate and reside. We know how important such contributions are to the overall health of the Ghanaian economy, and the obligations we have as a company to contribute to a stable operating environment,” said Danquah Addo-Yobo, Head of Finance for Newmont’s operations in Africa.

“Government acknowledges and appreciates Newmont’s consistency and promptness in meeting its financial obligations to the state, which will support our efforts at strengthening the Ghana cedi and the overall Ghanaian economy,” said Hon. Dr. Cassiel Ato Forson, the Minister of Finance.

Newmont is Ghana’s largest gold producer and a significant contributor to the local and national economy by way of taxes, carried interest, employment, procurement, and social investment. The company is focused on driving its purpose of creating value and improving lives through sustainable and responsible mining.