Ladies and Gentlemen, thank you very much for being present for our engagement. On 24th July, the Finance Minister presented the Mid-Year Fiscal Policy Review, an assessment of the policies, programs and targets outlined in the main Budget presented on 11th March 2025.

We want to take this opportunity to once again extend our condolences to the family of the late Hon. Ernest Yaw Kumi. Together with us as a caucus and the good people of Akwatia, we have sadly lost an affable and hard-working young man. We will continue to keep them in our prayers and support them in every way possible.

May God keep his gentle soul and forgive those who, out of vain glory and needless aggression, failed to respect the will of the Akwatia People. As the constituents have said, ‘se asa’!!

In fact, if the people of Akwatia were listening, they would wonder where this self promoting report on the economy has been concocted from. Like many of our people out there, we are wondering whether the Government and the Minister live in this same Ghana.

If drivers were listening to the Minister’s Budget Review speech, they might question whether the Minister is trustworthy. In just 5 months of managing the public purse, the Minister has broken his promise to pursue efficiency and has introduced the Dumsor levy. Today, we are all paying almost GH¢4.00 for every gallon of petrol we buy. This goes against the promise to reduce the cost of petrol.

If utility-paying Ghanaians were listening, they would ask if the Government is honest. In the first half of the year, this Government and the Minister have increased electricity tariffs by a cumulative 17 percent. This same Minister, on 3rd March, pledged during his so-called Economic Dialogue, not to let the ordinary Ghanaian pay for the inefficiencies of ECG and the energy sector. What has changed?

If the Small-Scale Miners were listening, they would wonder what they had just heard. In just three months, the Government has failed to fund the Goldbod it established. The Bank of Ghana has been paying upfront and incurring unnecessary costs because GoldBod has failed to raise the required resources for its operations and has also failed to pay a competitive price for the gold it purchases from small-scale miners. The result is that, last two weeks, small-scale miners expressed their frustration. They are highly displeased with the prices paid to them by the GoldBod, even when global gold prices are at a record high. They are facing hardships.

If the spare parts dealers were listening, they would marvel at the Minister’s deception. Just last two weeks, the spare parts dealers in Kumasi demanded action on the unfulfilled promise to reduce the duty at the Ports. This month, we witnessed a demonstration by residents on the Ofankor-Nsawam road as the Government has failed to fund the contractors to continue work on these national roads.

If the nurses were listening, they would note how insensitive this government is. If everything is as good as the Minister wants us to believe, why did the government fail to meet the needs of the nurses? The Ghanaians who lost their family members and were affected by the nurses’ strike know better.

If the 320 recruits who have been unjustly sent home from the Ghana Police Service heard this, they would realise that this narrative is not about the Ghana they live in. If the over 730 recruits wrongly denied employment in the Ghana Immigration Service were listening, they would treat the Minister’s presentation with scepticism.

If the 50 young people unfairly denied jobs at the Narcotics Control Commission heard this, they would see it as high-pitched propaganda. The collective experiences of many young people being wrongfully denied employment offer no reassurance regarding the promise to recruit over 70,000 health personnel currently awaiting placement.

2.0. EXTERNAL SECTOR RECOVERY AND RESERVE ACCUMULATION

The current account recorded a surplus of 1.1 percent of GDP in 2024, reversing the deficit of the prior year. Gross international reserves reached US$8.9 billion by end-2024, well ahead of IMF targets.

This performance stemmed from:

- Higher gold exports and remittances,

- Strong FX inflows via the BoG’s Domestic Gold

Purchase Program, started by the NPP government in 2023, which mobilized over US$3.6 billion in 2024,

- Prudent FX management and monetary policy

Yet the Mid-Year Review fails to acknowledge that this buffer was inherited. The Minister’s attempt to disassociate today’s gains from yesterday’s effort is both analytically flawed and institutionally damaging.

For example, the Minister was upbeat about this government achieving accumulated “Gross International Reserves of US$11.12 billion covering 4.8 months of imports as at the end of June 2025 compared to US$8.98 billion, covering 4 months of imports as at end December 2024”.

What the Minister did not tell the people of Ghana is that the US$11.12 billion is not completely a new accumulation. It includes US$8.9 billion the government inherited from the previous NPP Administration. The only new addition was US$2.2 billion.

Curiously, the Minister also praised the Ghana Goldbod for bringing in US$5 billion in the first half of the year. One wonders how the addition to the Gross International reserves in the first half of the year was US$2.2 billion in spite of the US$5 billion brought in by Goldbod.

We may want to ask the Minister and the Bank of Ghana what they did with the extra US$2.8 billion, because all along, we have known that the Bank of Ghana has been pre financing gold purchases by the Goldbod.

In any case, we are not sure about the level of scrutiny the Goldbod is subjected to.

Whereas the Minister stated that, in the first half of 2025 alone, gold exports from the small-scale sector stood at 51.5 tonnes, with an export value of approximately US$5 billion, that is up to June, 2025; President Mahama on the other hand said, a few weeks ago, that Ghana earned US$5 billion from nearly 52 tonnes of gold exported between

January and May 2025. This apparent contradiction between the President and his Finance Minister calls for proper scrutiny of the work of the Goldbod.

On the exchange rate situation, the Minister indicated that “cedi no apicki!.”

The developments in the foreign exchange market under this administration are deeply troubling. We are witnessing persistent arbitrage between the Interbank market and forex bureaux, alongside a growing scarcity of foreign exchange. Perhaps, the Minister should know that “Cedi no apicki, but Abochi get the Dollar, as my brother Hon. Adongo once said.

The shortage of Dollars in the Banks has been so pronounced that importers have gone public to express their frustration about the situation.

It is evident that the Bank of Ghana has been intervening significantly in the FX market through auctions, bilateral sales, and other tools, despite the Bank of Ghana Governor denying such interventions were happening.

It took the IMF to disclose that in Q1-2025 alone, the Bank injected over US$1.4 billion into the market. Yet these interventions remain ad hoc, opaque, and devoid of a rule-based framework. And this is why the IMF has cautioned the Bank about the sustainability of such a policy.

As the IMF rightly observed: “Looking ahead, deepening the interbank FX market by

reducing BoG’s footprint and allowing for greater exchange rate flexibility—including through the adoption of a formal internal FX intervention policy framework—should be a priority.”

We on the Minority side are interested in measures that sustainably address the FX situation, including reducing our dependence on cheap imported products, which drains significant FX from the country every year, by deliberately improving domestic production through initiatives such as 1D1F. The next NPP government will address FX Flows (including black Market activities), Import/Export Traders’ activities, FX Transaction execution, and FX Innovation/Improvements to permanently address currency issues.

3.0. DEBT RESTRUCTURING

In the Mid-year Review, the government praised itself for a number of unearned achievements.

The Minister stated:

- That Ghana’s public debt-to-GDP ratio as at end-June 2025 was 43.8%, from 61.8% at the end of 2024, thus, the public debt as a percent of GDP reduced by 18% in six months.

- That Ghana’s foreign debt, as a percentage of total public debt, declined from 57.4% as at end-December 2024 to 49% by end-June 2025.

- That this has significantly improved Ghana’s debt sustainability.

- That our debt-to-GDP ratio is at a 5-year low;

The question we ask the Minister is: How much of Ghana’s public debt has the government repaid, which has led to the reduction in the public debt and the subsequent improvement in Ghana’s debt-to-GDP ratio?

It is no secret to any of you in the media the painstaking efforts the NPP government made to restructure our debts particularly with our external commercial creditors that led to outright debt cancellation of US$5 billion and debt service savings of US$4.7 billion.

This is what we mean by debt reduction. What then did the NDC government do to claim reduction in the public debt?

In the same Mid-year Budget, the Minister tried to claim another unearned credit when he stated that “Our credit rating has improved from junk to B-, with stable outlook, a two-notch upgrade and a 4-year high”.

Again, it is well known to you that he made no contribution to this rating upgrade by Fitch. In the words of Fitch:

“The upgrade of Ghana’s Long-Term Foreign-Currency IDR to ‘B-‘ from ‘RD’ reflects Fitch’s assessment that Ghana has normalized relations with a significant majority of external commercial creditors. Ghana restructured its USD13.1 billon Eurobonds in October 2024”. – Fitch, Mon 16 Jun, 2025 – 12:31 PM ET.

Ladies and Gentlemen, was the Honorable Minister Dr. Ato Forsen the Finance Minister in October 2024? How could the Hon. Minister stand on the floor of Parliament and praise himself for this unearned credit?

Sadly, in his attempt to win public sympathy, he used copious pages to lambast former President Akufo- Addo for undertaking the debt restructuring exercise. Is it therefore not hypocritical to turn around and claim credit for the success of the same debt restructuring

How do you criticize an exercise, and accept the product of the same exercise? We know that Ghanaians understand this kind of economics, the NDC is using – Propaganda Economics.

We have now seen officials of this Government posing for photo opportunities with foreign officials for the announcement of debt relief for Ghana by our bilateral creditors.

Yet they cannot even show integrity by acknowledging the people who negotiated and

reached these agreements over two years, because there is a new government. How low can we go as a country?

4.0. INADEQUATE FUNDING FOR GOVERNMENT PRIORITY PROGRAMS

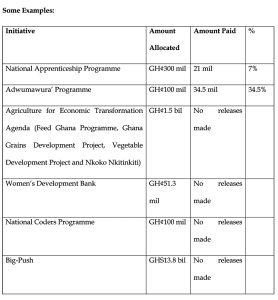

You will recall that during the debate on the 2025 Budget Statement in March, 2025, I pointed out my disappointment about inadequate provision for the priority programs of the Government, an indication that it does not intend to fulfil the promises they made to the Ghanaian people. The mid-year review has proven this case to be true as the Minister has failed to release adequate funds even for the programs that have budget lines for the Ministries to implement these programs

2nd July 2025. The Minister has now conceded in the Mid-year Review that it will provide

funding in the 2026 Budget to implement the program. The question is, why do you

launch a program when you have no budget to implement it?

We know why the Minister has failed to fund these priority programs of the Government for the first half of the year. Out of the total 28 treasury auctions held from January 3, 2025, to July 11, 2025, 13 auctions failed to meet the auction target, with bid-cover ratios below 1.0, despite high participation in the early part of the year.

Therefore, the Minister had to divert the funds meant for these priority programs to fund the auction shortfall, which would not have arisen if he had not manipulated interest rates on government treasuries.

The Minister celebrates the artificially induced interest rate developments in the treasury security auction, but the Central Bank has kept the Monetary Policy Rate (MPR), which acts as the base for setting rates, steady at 28 percent. Indeed, the Bank of Ghana’s OMO activities are carried out at an MPR of 28 percent.

This is a clear case of poor coordination between the Ministry of Finance and the Bank of Ghana. It is a case of fiscal policy misaligned with monetary policy. How can the Ministry of Finance borrow at an average of 15% for the past few months whilst the Bank of Ghana borrows at 28% from the same market?

Isn’t it intriguing that the same market shows such significant arbitrage in rates even though the OMO bills are purchased solely by banks? The Minister’s actions have greatly affected price discovery in the market.

The Bank of Ghana is conscious of the inherent risks in the economy and is not prepared to follow the complacent path taken by the Finance Minister.

In fact, even with all the noise they made about the Goldbod, including pushing the Goldbod bill through a certificate of urgency, the Minister has not released a cent out of the US$279 million he allocated as revolving fund for the Goldbod.

All the gold the Goldbod has purchased so far have been pre-financed by Bank of Ghana, the same Bank

that said it was withdrawing from the Gold-for-Oil Program. Notwithstanding this prefinancing, the Bank of Ghana’s gold reserves have not increased.

So, what has the Bank been funding the Gold for? This is a clear case of monetary financing, which the NDC in opposition criticized us for doing, including demonizing top officials of the Bank of Ghana.

Under the IMF Program, the Government and the Bank of Ghana signed an MoU to halt monetary financing of the Government. This is a violation of the. Agreement.

We call on the Bank of Ghana to disclose the total amount of monetary financing it has done in the

spirit of transparency and accountability for public scrutiny.

5.0. WAGE PRESSURES

The Minister, in his address, tried to justify the dismissal of over a thousand Ghanaian youth from employment just because they were recruited under the NPP Government.

And for those who were lucky to escape from the wicked hands of the NDC government, they are being blamed for the alleged wage pressures on the government.

To put this in context, let me quote the Minister:

“Mr. Speaker, we have seen some significant pressures on the compensation budget for the first half of 2025 mainly emanating from wages and salaries. Wages and salaries exceeded the budget by GH¢1.3 billion for the first six months of the year.

The wage pressures were largely driven by last-minute recruitments undertaken by the previous

government in the last quarter of 2024, especially in the education, health and security sectors.

We will issue an Executive directive mandating all MDAs to seek approval from the Minister of Finance before making any commitments with financial implications on the payroll”. This is unfortunate and shocking!

First, all recruitments into the sectors mentioned by the Minister – the education, health and security sectors recruit only after financial clearance from the Ministry of Finance.

What does he mean by issuing an Executive Directive for MDAs to seek approval from him before committing the government on the payroll?

Second, before the 2025 Budget was presented and approved in March 2025, the government had full knowledge of all the recruitments. It is sad that they did not budget for it only to now turn to complain of exceeding the vote for wages and salaries.

The Minister was, however, blind to the hundreds of Advisors and Special Assistants and Media Specialists that they imposed on various MDAs. If he wants to know the reason for the excessive wage budget, he should not look far. His office alone has countless number of these Advisors.

It is important to state that Ghanaian workers have been dealt a raw deal. While the government adjusted wages by just 10%, its revenue policies have increased the burden on the Ghanaian worker.

The Government statistician only last week announced that electricity inflation reached 139% by June, 2025, 10 times more than the national inflation rate. We also know that the Dumsor levy of about GH¢4 per gallon of petroleum has been operational since 16th July, 2025 and has led to prices of petroleum products increasing by 8% contrary to the promise by the Government.

Whilst the Hon. Minister for Finance described the introduction of the levy as “intelligent”, the Hon. Minister for Energy and Green Transitions boasted that the levy would not lead to petrol price increases. Now, Ghanaians can see the people we have entrusted our economy with.

And just when many Ghanaians were getting used to the Dumsor levy and its effects, the Government used the Mid-Year Budget to increase the levy on Marine Gas Oil used by vessels in the fishing industry from 23 pesewas per liter to GHS1.93 per liter. This I call “Fishing Levy”!

This is the same government, if you recall, that said it would not resort to taxes to raise revenue but will rather cut down on waste to save revenue to fund the budget. We are in the 6th Month of this administration, and one wonders how costly the future will be in this country.

And when the people of Ghana were expecting the government to use the Mid-Year Budget to fulfil its promise of abolishing the COVID-19 levy, it came to make another promise it will abolish it in the 2026 Budget. I have not seen this level of disrespect by a Government to the Ghanaian people.

6.0. INACCURACIES IN DATA

Ladies and gentlemen, typical of the Finance Minister, his mid-year presentation was full of misleading data/information. I must say that it is unfortunate that anytime the Finance Minister speaks he entangles himself with such deliberate falsehoods just for political expediency. This is not good for our image as a decent nation and for the integrity of the

Minister also.

✓ The Minister’s attribution of the 2022 economic crises as being significantly due to corruption and reckless expenditure is very unfortunate!!

✓ The primary surplus recorded at the end of June 2025 is not the first in history as the minister sought to mislead.!!! In the years 2017, 2018 and 2019 Ghana recorded primary surpluses by the previous government. In fact, the 2017 primary balance surplus was rather the first attained after more than a decade. Again, during the first half of 2024 Ghana recorded primary surplus.

✓ The Minister’s claim in paragraph 183 of the mid-year budget statement that for the first time in Ghana’s history, there is a negative 15.6% rate of debt accumulation because public debt reduced by GH¢113.7 billion in six months is not true

The fact is that, on account of the heavy appreciation of the cedi in December 2022, Ghana’s external debt stock reduced by GH¢141.8 billion (about 37%) from GH¢82.7 billion in November to GHc240.9 billion in December. This level of debt stock reduction is

higher than what is recorded by this government. Again, the cedi appreciated in value by 57.8% from 13.1 to 8.3, more than the level of appreciation recorded this year.

Rather than using propaganda to smear the previous government, I will advise the Minister to show humility and appreciate the solid foundation laid for him to chalk success. The Minister in paragraph 184 touts the significant debt to GDP ratio reduction, and I know this will further go down after the rebasing. What he should know is that Ghana’s Debt-to-GDP Ratio has reduced significantly, largely due to some robust measures instituted by the previous NPP government:

– Debt relief under the debt restructuring programme instituted by the previous government — e.g., France has cancelled €87.7M of our debt.

– GDP expansion under the previous government, which raised the denominator and helped ease the debt ratio. There ahs been no major shifts in the fiscal space, apart from the Cedi appreciation supported by those reserves.

– GDP grew from 4.9% in Q1 2024 to 5.3% in Q1 2025 an 8% improvement. For context, there was a 50% jump in GDP growth from 4.4% in Q1 2016 to 6.6% in Q1

2017.

✓ The Minister’s claim that the government has been able to reverse cedi depreciation to the 2022 level is also false! He claimed in his presentation that the cedi-dollar rate that was GH¢17 to $1 is today GH¢10.4 to $1! This is complete falsehood. GH¢14.7 to $1 was the rate at the time NPP handed over power to them.

To use the Minister’s own words to defeat the misleading information he put out, I refer you to paragraph 43 (vii) of the mid-year review statement.

“As at the end of June 2025, the Cedi appreciated by 42.6% against the dollar …”

This 42.6% rate of appreciation can only be a statistical match to a rate within the 14 cedidollar band and not 17 cedis. In fact, if you use 17 cedis then the rate of appreciation should be around 65%. So where did the Finance Minister get his 17 from? In fact, the cedi never traded at 17 cedis-dollar in the entire 8 years of the previous administration.

This lie must be put to rest.

7.0. EXCHANGE RATE STABILITY

Exchange rate stability is crucial and very much needed for economic certainty and progress, especially if it is underpinned by economically aligned natural causes. In fact, I must say that two key features are important as far as any currency is concerned:

– The rate of exchange of the currency with its major trading partners, and

– The purchasing power of the currency.

It is instructive to note that the true value of any currency does not lie in its rate of exchange but

the purchasing power. What is the purchasing power of the cedi to the ordinary Ghanaian today at Malata market, Techiman market, Abofour market, or the streets of Chorkor, Tudu, Adum, and so on?

CEMENT

❖ Cement Price in January 2025

– 90 cedis

❖ Cement Price in April 2025

– 130cedis

SURE DEODORANT

❖ Price in January

– 35 cedis

❖ Price in July

– 45 cedis

STANDARD LOAF OF BREAD

❖ Loaf of Bread in January

– 18 cedis

❖ Loaf of Bread in July

– 23 cedis

Bottled WATER

❖ A Pack of bottled Water in January

– 28 cedis

❖ A Pack of bottled Water in July

– 36 cedis

KENKEY

❖ Ball of Kenkey in January

– 3 cedis& 5 cedis

❖ Ball of Kenkey in July

-5 cedis& 7 cedis

These are the stark realities of the bread-and-butter issues in the streets of Ghana. This is what the government should be interested in to lessen the burden of the poor Ghanaian.

8.0. FISCAL CONSOLIDATION

Early this year, the Mighty Minority drew government’s attention to the attempt by the central bank to pump dollars in the forex market to achieve stability. This was denied with all the vehemence by government. Despite the IMF’s recent caution to the government, which also corroborated our earlier suspicion that the government had put the cedi on dollar steroids, the Finance Minister unashamedly denies the fact that BOG interventions in the secondary forex market on the back of the strong reserves built by the NPP administration is the Significant reason for the strength of the cedi.

Unfortunately, he says a certain fiscal consolidation is the reason for the strength of the cedi. Strangely, we are not told the specific constituents of the fiscal consolidation that have driven this stability.

But I have a problem with the fiscal consolidation efforts implemented by this government. Yes, fiscal consolidation seeks largely to address the imbalances in government revenue and expenditure to reduce budget deficits and public debt. You achieve this through various measures, including spending cuts, revenue increases, and debt management.

Among these three, a careful observation of this government’s fiscal consolidation efforts points to one main thing – increasing revenue through taxes. I say this because, while government’s spending cuts approach is incoherent, not substantial and completely nebulous, not much is realized from its debt management approach. Rather, we have seen substantial efforts at either leisurely introducing new taxes or increasing existing ones.

In seven months, after claiming to abolishing taxes that were not nonexistent, this government has introduced about 10 new tax handles in just seven (7) months, unprecedented in our recent history.

- Increased Growth and sustainability levy from 1% to 3%

- Increase the sunset clause of the growth and sustainability levy from 2025 to 2028

- Increased the 1% special import levy

- Introduced 21.9% VAT on non-live insurance premium excluding motor vehicles

- reintroduced road tolls

- Increased fuel prices by 5% on diesel and 2% on petrol

- 2.5% increment in electricity tariffs

- Increased prices of locally manufactured plastic products by 7%

- 4% increase in water tariffs

- 14.75% increase in end-user electricity tariffs in April and another 2.45% increase in July. Just last week, the Ghana Statistical Service reported that electricity inflation has gone up year-on-year by 139.3%.

With this, one does not need a seer to tell us the average Ghanaian is being made worse of. These taxes have introduced significant structural cost pressures, and they are affecting the everyday life of the Ghanaian.

Of what benefit is fiscal consolidation if the underpinning catalyst is tax increases?

A fiscal consolidation at the burden of the Ghanaian taxpayer is notting but a rip-off.

Ladies and gentlemen, while Ghanaians have been reeling under these harsh and difficult tax regimes, the government is introducing some more hardships by increasing fees and charges for some public goods and services by between 30-40%. With this, Mr. Speaker, Transport & Vehicle Services

❖ Vehicle registration fees will go up

❖ Road worthiness inspection charges will go up

❖Drivers license renewal fees will go up

❖ Commercial transport permits will go up

❖The concomitant effect is that transport fares will go up

Education related charges

❖ Exam registration fees will go jup

❖ Teacher trainee certification & licensure fees will go jup

❖ School registration will go up

Business & Regulatory Services

❖ Business registration and renewal fees (Registrar General Department) will go up

❖ Trade, import/export licenses, permits (e.g. FDA, EPA,NLA) will go up

❖ Commercial signage and advertisements costs will go up

Health & Medical Services

❖ NHIS registration and renewal premiums will go up

❖ User fees for outpatient consultations and diagnostics tests will go up

❖ Charges for birth/death certificates and vaccinations will go up

Land & Judicial Services

❖ Court filling and hearing fees will go up

❖ Bail bond administration charges will go up

❖ Fees for official gazette publications and legal document searches will go up

❖ Notary and authorization fees will go up

Security & Identity Services

❖ Police clearance certificate fees will go up

❖ Fire certificate and licensing fees will go up

❖ Private guard/company licensing fees will go up

Immigration & Citizenship Services

❖ Passport application and renewal fees will go up

❖ Visa processing charges will go up

❖ Entry/departure stamp and certificate of citizenship fees will go up

❖ Work and residence permit fees will go up

Water & Sanitation

❖New water connection and meter installation fees will go up

❖ Monthly tariffs and services charges will go up

❖ Sewage and sanitation services fees will go up

- MISALIGNMENTS

The outturns show that the Minister has had to abandon his original fiscal program and adopt the recommendations that were made by the minority when the original budget was presented. The expansionary plan presented has now had to be cut by some GHs19 billion in line with the Minority’s call for cuts. It is because of this that the govt is able to achieve a 1.1% primary balance. Additionally contrary to the govts initial strategy to be able to increase revenue without introducing new taxes, the outturns at midyear show that the govts revenue strategy failed. After sweeping GH¢11 billion as balances brought forward and introducing 8 new taxes, the govt still has a revenue shortfall of 3 billion cedis.

Ladies and gentlemen the consequences of the failed fiscal strategy are that the new taxes will soon translate into inflation as is being warned by BOG while the 19 billion.

expenditure cuts without a compensating strategy are now affecting Govts ability to deliver on public goods and services.

The minority urges govt to adopt the following measures for the remainder of the year.

- Focus on strict enforcement of currency rules instead of artificially dumping dollars on the market to suppress the cedi. It is the reason for which supply of forex is limited leading to complains from importers that they cannot get dollars to service their forex needs.

- focus on mainstreaming PPPs as the expenditure cuts are affecting govt service

delivery

- withdraw the burdensome taxes to avoid inflationary pressures in the near future.

Additionally the increase in about 35% of fees and charges coupled with an increase of electricity prices by about 15% will in addition to the 8 new taxes, hamper the disinflation efforts of urgent care isn’t taken.

It is worth noting however that the govt is continuing with the Gold Purchase program started by the NPP in 2021 and the tight monetary policy commenced in Jan 2023. We commend govt for continuing with these.