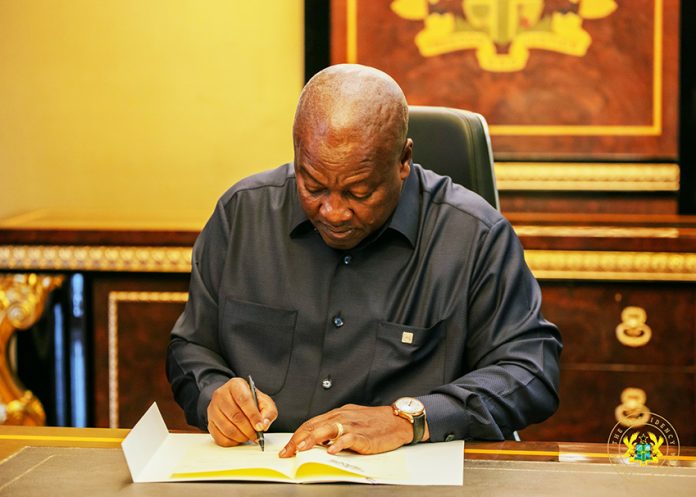

President John Dramani Mahama on Wednesday, April 2, 2025 assented to the Value Added Tax Amendment Bill, 2025.

The object of the Bill is to amend the Value Added Tax Act, 2013 (Act 870) to exempt the supply of motor vehicle insurance from Value Added Tax.

The Government has observed that the imposition of Value Added Tax on motor vehicle insurance has had a direct impact on household incomes as the incidence of the tax falls significantly on persons who cannot recover the tax.

Additionally, for commercial drivers, the imposition of VAT on motor vehicle insurance could lead to increased costs, as they may transfer the tax burden onto commuters by increasing fares.

Consequently, the Government has decided to exclude motor vehicle insurance from the scope of VAT on non-life insurance.

The passage of this Bill will provide relief to households and commuters while ensuring a fair and balanced tax system.

The event, which took place at the Presidency, was witnessed by Dr Cassiel Ato Baah Forson, Finance Minister, Mr Ebenezer AhumahDjietror, the Clark to Parliament, Mr Julius Debrah, the Chief of Staff and Mr Felix Kwakye Ofosu, the Presidential Spokesman and Minister in-charge of Government Communications.

The rest are Mr Seth Emmanuel Terkper, a Presidential Advisor on the Economy and a former Finance Minister, Mrs Joyce Bawah Mogtari, Special Aide to the President and Presidential Advisor and Mrs Marietta Brew Appiah-Oppong, Senior Legal Advisor to the President.

In a related development President Mahama signed into law the Petroleum Revenue Management (Amendment) Bill, 2025.The object of this Bill is to amend the Petroleum Revenue Management Act, 2011 (Act 815) to ensure that the entire Annual Budget Funding Amount (ABFA) is dedicated solely to infrastructure development.

The passage of this bill will ensure that the allocation of ABFA funds, which was previously spread across multiple projects, limiting their impact and reducing the ability to complete transformative legacy projects will end.

The amendment will ensure that all ABFA funds are dedicated to infrastructure projects under ‘The Big Push’ programme, which aims to deliver significant, high-impact projects that will leave a legacy.

This will enhance the efficient utilisation of petroleum revenues and yield tangible developmental outcomes.

The amendment would also ensure that the five percent allocation is also applied to infrastructure development.

GNA